Table of Content

Early withdrawal means taking money out of your 401 before you’re ready or old enough to retire. Apply online for expert recommendations with real interest rates and payments. Unfortunately, this big upfront cost can prevent many from diving into their dreams of homeownership right away. If you are looking to buy a house but are short on cash, then it might be tempting to use the funds you need from your 401k. See all available first-time home buyer grants and programs.

With that, it might be tempting to pull funds from your 401k to cover the down payment of your home purchase. HomeReady is best for buyers with low- to moderate-income and average credit scores or better. HomeReady is best for buyers with low- to moderate-income and below-average credit scores. In its list of exceptions, the IRS notes that first-time home buyers can use up to $10,000 from their 401 toward purchasing a home.

Is using 401k to buy a house a good idea?

Since you’ll be taxed again on withdrawals during retirement, the interest payments will end up being double-taxed. In other words, if you borrow a large amount, the payments could be substantial. If possible, roll over the amount you want to withdraw to an IRA, so you can avoid paying the penalty.

Let’s break down whether you should make a 401 withdrawal to buy a home and other alternatives. A financial advisor can help you create a financial plan for your home buying needs and goals. A Roth 401 is an employer-sponsored retirement savings account that is funded with post-tax money. You can withdraw money from 401, but you will incur an early withdrawal penalty of 10% as well as taxes.

How Can I Use My 401(k) to Purchase a Home?

If you do not have substantial retirement funds, you could find yourself in a financial bind in your senior years. Money from a 401 withdrawal for hardship reasons can’t be used to cover monthly mortgage payments, mortgage insurance payments , property taxes, or paying your real estate agent fee. This depends on what accounts you have and how much you have contributed to them. But in general, you’ll be assessed fewer taxes and penalties if you withdraw money for your down payment from a Roth before a traditional IRA, and from either of those before a 401k.

We offer this because we're confident you're going to love working with a Clever Partner Agent. Get the latest real estate news and tips with our free weekly newsletter. A combination of the above two options can also be utilized if you have more than one 401k. Our mission is to empower women to achieve financial success. Is a writer for Clever Girl Finance who enjoys helping people make better financial decisions.

withdrawals for home purchase: Is it possible?

As you can probably tell by now, using your 401 for a down payment on your first home should not be your first option. You’re essentially stealing from your retirement future to fund today’s expenses. Buy sooner and start building home equity instead of renting. If you’ve been delaying a first-time home purchase because you can’t seem to get the full down payment saved, borrowing from your 401 may be the temporary boost you really need. Navigating all this can be tricky, so we recommend reaching out to a RamseyTrusted real estate agent.

And the IRS rules don’t find a situation a hardship if you have other ways of paying for the expense, like money from a spouse or child.2 It all depends on your employer’s 401 rules. A Federal Housing Administration loan is a government-backed mortgage with looser requirements designed to make it easier for first-time home buyers to purchase a property. This includes low down-payment options and lower credit score requirements. For this reason, an FHA loan may be a better option than making a withdrawal from your 401. However, If you need to take a distribution from retirement savings, consider all of your options, including taking withdrawals from an IRA or delaying homebuying to save more cash. To use money in a traditional 401, you can take an outright withdrawal or a 401 loan.

Not all employers offer 401 loans as an option in their retirement plans, though. It’s also important to note that you are still required to repay the loan even if you leave your current job or are laid off. In fact, your repayment period shortens once that happens, and the loan must be repaid in full by the next tax filing date. Homebuyers who borrow from their 401 plans can’t make additional contributions to the accounts or receive matching contributions from their employers while paying off the loan. Depending on how much they were contributing, these home buyers could miss out on years of retirement contributions while they’re paying back the loan. That could take a substantial bite out of their overall retirement savings.

If you need $25,000, you can simply take out a loan for $25,000 (assuming you have at least $50,000 in the account). Depending on the specifics of your account, you may also be eligible to take out a home loan of up to $50,000 against your 401K. Twin Cities Habitat for Humanity is an Equal Opportunity housing agency and Equal Opportunity Affirmative Action employer. You could own a home you love with a mortgage you can afford. Mortgage.info is your information portal for all things home, mortgage, and refinancing.

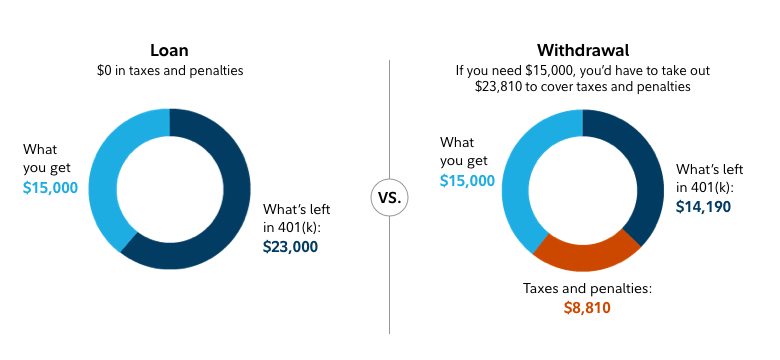

Along with the fee, you’ll need to pay income tax on whatever you withdraw from your 401. So, if you face a 20% income tax on top of the early withdrawal fee, your $10,000 withdrawal just becomes $7,000. When you take out a 401 loan, you do not incur the early withdrawal penalty, nor do you have to pay income tax on the amount you withdraw. A 401 loan must be repaid with interest, but you don’t have to pay income taxes or tax penalties. You’ll want to find out how much you’re able to borrow, the interest you’ll have to pay, and the repayment period. To avoid paying for mortgage insurance, you must make a downpayment of at least 20% of the purchase price of your home.

Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely won’t qualify for an exemption. Even if you do, your withdrawal will still be taxed as income. Many first-time home buyers have some type of debt to worry about.

The problem is that with a new house payment, regular home maintenance expenses and a possible home repair issue, it may be difficult to pay back the loan. If you're certain that you want to use retirement funds for a home down payment, your IRA will generally be a better option than your 401. You want to buy your first home, but with everyday expenses taking the bulk of your paycheck, saving enough for the down payment seems impossible. You might be wondering if you can use the funds in your 401 to give you that boost you need to finally go house-hunting. No matter how much you’re putting down, go for a fixed-rate 15-year mortgage with a monthly payment that’s no more than 25% of your take-home pay . Leave the money in your 401 alone until you’re actually ready to retire.

No comments:

Post a Comment